Flagler County Schools will ask voters to renew half-cent sales tax for technology

The Daytona Beach News-Journal | By Cassidy Alexander | November 30, 2021

The Flagler County school district is preparing to ask voters to renew its half-cent sales tax, which has supported technological advancement in the district for almost 20 years.

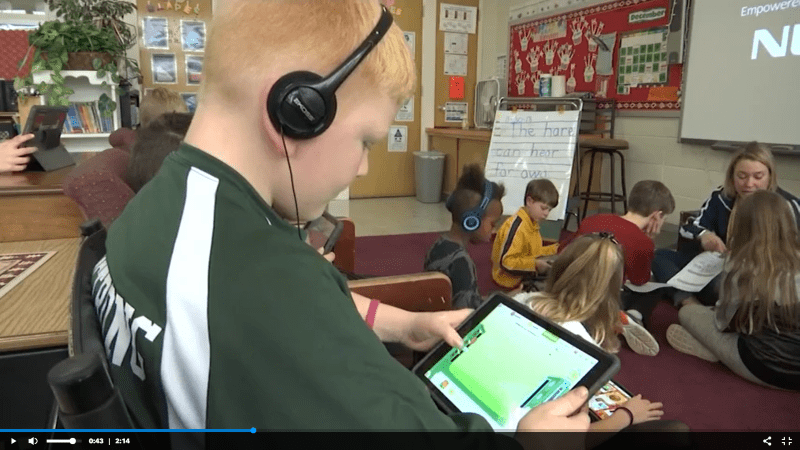

Since it was first approved in 2002, the district has purchased computers or iPads for every student; expanded wireless access districtwide; reorganized its technology services to provide support at home as well; and weathered the shift to remote learning during the COVID-19 pandemic.

“We would never be where we are today (without it),” said School Board Vice Chair Colleen Conklin at a recent board workshop. “This has been a lifeline for our students.”

School boards in Florida are limited on what taxes they can levy themselves, and often rely on asking voters directly if they’re willing to add an additional tax. Some districts ask for an added property tax. Others ask for up to an extra half-cent sales tax, which only applies to retail purchases in the county. The money can only pay for capital projects, like building and updating existing schools, and technology improvements or implementations.

Flagler County voters first approved the 10-year tax in 2002. When it came up again in 2012, it was renewed with 64% of the vote.

If the tax is renewed, Flagler County’s overall sales tax will remain at 7%. That is slightly higher than neighboring Volusia and St. Johns County, both of which have a 6.5% sales tax.

Last year, the Flagler County School District expected to raise about $8 million from the sales tax per its budget documents.

“if we don’t get that half-penny, we’re going to be struggling,” said board member Cheryl Massaro. “We’re small, but that’s how we can make a difference.”

The School Board will begin organizing an information campaign in the new year to make voters aware of the tax and how it’s helped the schools. In May, it will go to the Flagler County Commission and ask for approval to put it on the ballot in the 2022 election; then by June, the Flagler County Supervisor of Elections will need to receive the proposed ballot language.

The half-cent sales tax proved its worth during the pandemic, board members said.

The Volusia County school district, for example, had to pivot quickly to provide materials and equipment to all of its students. By early 2021, it had a plan to lease enough laptops for its 33,000 secondary students. But Flagler County had that equipment when the pandemic began in early 2020. District leaders say the equipment, infrastructure and previous staff training enabled them to pivot that much quicker to deliver education to students.

“Who’d have ever thought that COVID would kind of wreak the havoc that it did,” Conklin said, “but because we had already made that investment — because the community had already made the investment — we were able to turn it around rather quickly.”

That said, the pandemic also exposed an area that needs more attention: internet access in rural areas. There were times when district-provided hot-spots didn’t work, and now the county is working on expanding broadband access around the area.

“Hopefully everyone else rallies around us so we can get this done,” said board member Jill Woolbright.

Tensions recently flared between the School Board and the County Commission over a request to increase impact fees. The board had to ask the county for permission to do that as well, and commissioners were dubious about the effort to nearly double the fees. The district hoped it could cover costs associated with the enrollment growth it’s projecting. It’s simultaneously going through a process to redistribute which students attend which schools, in an effort to take advantage of any free space.

Dozens of Florida school districts have a half-cent sales tax, including Volusia, St. Johns and Orange. Duval County voters approved the tax for the first time last year.