Hillsborough schools will borrow $75 million to meet payroll

The district’s financial situation is more dire than it appeared early last week. That’s changing how the School Board views proposed staff cuts.

Tampa Bay Times | by Marlene Sokol | September 28, 2020

TAMPA — Superintendent Addison Davis faced a skeptical School Board last week over his plans to save money by cutting staff.

But all that changed less than 48 hours later, when he hit them with news that they must borrow soon to meet operating expenses.

The school district’s cash reserves are projected to dwindle to $9 million in early November. “That’s about one day’s worth of expenses,” chief financial officer Gretchen Saunders told the board Thursday.

To avoid the risk of running out of money, the district wants to issue a tax anticipation note, a form of short-term financing used by other school districts in similar situations.

School Board members did not object, and they vowed to support the administration’s efforts to rein in spending.

This second conversation took place at “agenda review,” a new kind of workshop Davis introduced when he took over this year.

While the agenda review is noticed under the Florida public meetings law, it happens without any video cameras or live-streaming. The Tampa Bay Times receives audio recordings a day or two afterwards.

That’s not the only difference between the two meetings.

At Tuesday’s televised board meeting, constituents lined up by the dozens to try and protect classes and programs that are vulnerable because of low enrollment. Some board members, who have been contacted individually by concerned parents and teachers, asked Davis to slow down the job cuts.

But on Thursday, confronted with Saunders’ bleak prediction, they focused on the bottom line.

“We have found ourselves in this situation, and we do have to be proactive,” said board member Tamara Shamburger.

“In all my years of being with this district, we are in the worst financial shape I have ever experienced,” board member Lynn Gray said.

Karen Perez, the board member who had challenged Davis earlier for his executive hires and his remodeling of district offices, said on Thursday, “this is definitely an alarm for us.”

Chairwoman Melissa Snively said,“this is a terrible place to be. Honestly, it’s embarrassing.”

Snively described a constituent who contacted her because her child’s class was being cut. “It was called ‘Fables and Storytelling,’” she said. “That sounds like a really cool class. But maybe if there are 12 people in that class, or six students in that class, maybe we don’t offer Fables and Storytelling until we get enough students.”

Only board member Steve Cona held to the position he took on Tuesday. “This is not a good place to be,” he said. “It’s a terrible place to be. And it’s important that we don’t understate where we are financially.”

School districts often find themselves low on cash in the fall months because money does not come in on the same schedule as it is paid out. They wait for large payments near the end of the calendar year from property tax collections, which flow through the state.

This year, however, the coronavirus pandemic has created uncertainty in the payment schedule. Hillsborough property owners might even be allowed to postpone their payments.

While it is not certain that the district would run out of money, Saunders and Davis said they do not want to risk that possibility.

The district, as a precaution, takes out a $100 million line of credit from Wells Fargo Bank every year. But it has never had to draw on that line of credit, Saunders said. Nor has the district, in her memory, ever floated a tax anticipation note.

Both are forms of short-term financing, but the tax anticipation note has better terms, she said. A three-month loan for $75 million will cost the district about $84,000, which it can pay with money from purchasing rebates.

The board will vote Oct. 6 on this action.

In an interview Monday, Davis said if district leaders do not take their spending problems seriously, “we will never get finances back in line in the future so we can establish innovative solutions, innovative pathways and, at the same time, become fiscally healthy so we can implement a vision for the work and really create excitement over what we offer children.”

When Davis’ team first began addressing the budget issues about a month ago, they blamed some of the losses on COVID-19 expenses, lower student enrollment and a growing exodus of students into privately run charter schools.

On Thursday, however, deputy superintendent Michael Kemp said that even without these three factors, the district would be in trouble because of a longstanding pattern of over-hiring, using grants that eventually expire.

“Our credit cards, so to speak, they’re maxed out,” he said.

An efficiency study is under way by the Council of Great City Schools. The district went through a similar process four years ago when it brought in the Gibson Consulting Group, which also found the system was overstaffed.

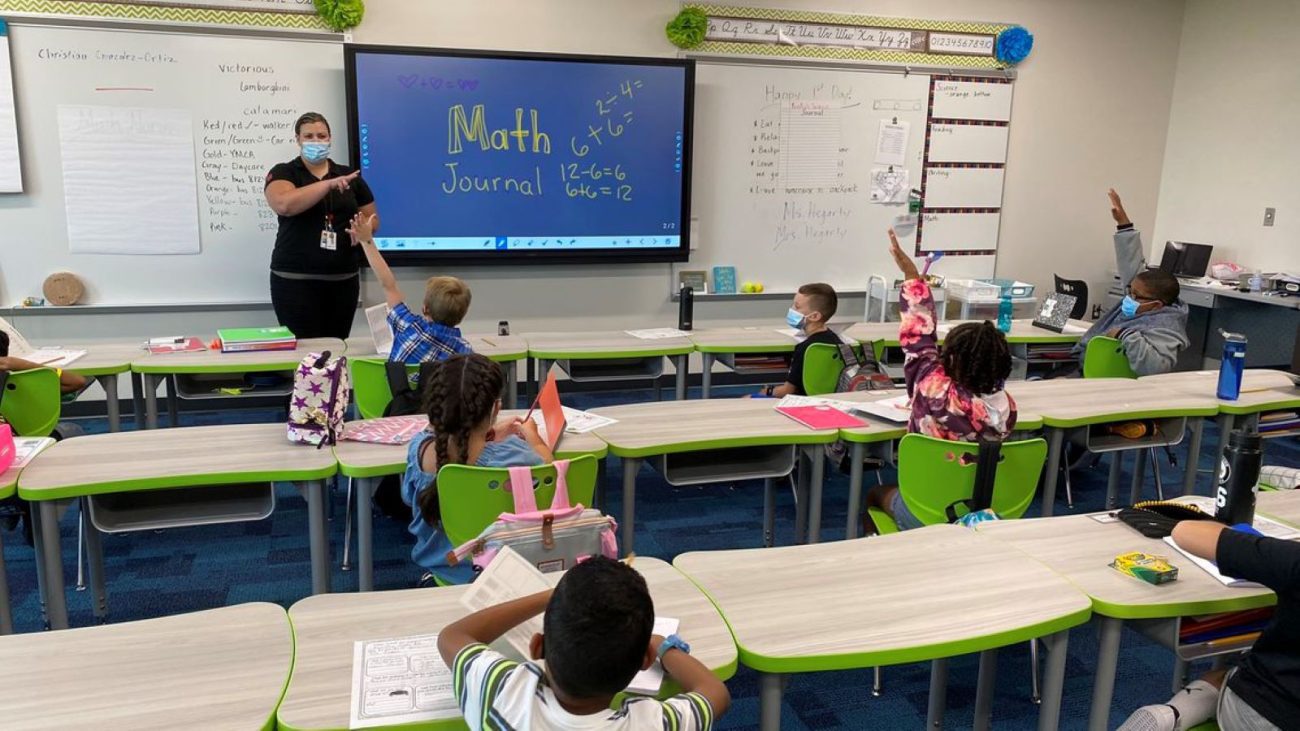

Featured image: Teacher Mary Hegarty addresses her class at Belmont Elementary in Hillsborough County on the first day of in-person school, Aug. 31. District officials say they will need to borrow millions to keep schools running this fall. [ Hillsborough County School District ]