States Should Bolster, Not Undermine, Education Gains Made with ESSER Funds

Center on Budget and Policies Priorities | By Joanna LeFebvre | August 29, 2024

An unprecedented $190 billion federal investment in education during the COVID-19 pandemic improved academic achievement and prevented potentially catastrophic social and educational losses for many public school students. That federal funding, known as Elementary and Secondary School Emergency Relief (ESSER), expires at the end of September. Instead of cutting revenue that could be used for public education at such a time — as about half the states are already doing — states should build on the progress that additional funding provided by raising revenue through progressive taxes and by keeping public funds in public schools. Investing in public education is good policy: Long-term investments can help achieve equitable outcomes for students from families with low incomes, and yield lifetime benefits, including higher wages, higher educational achievement, and reductions in adult poverty.

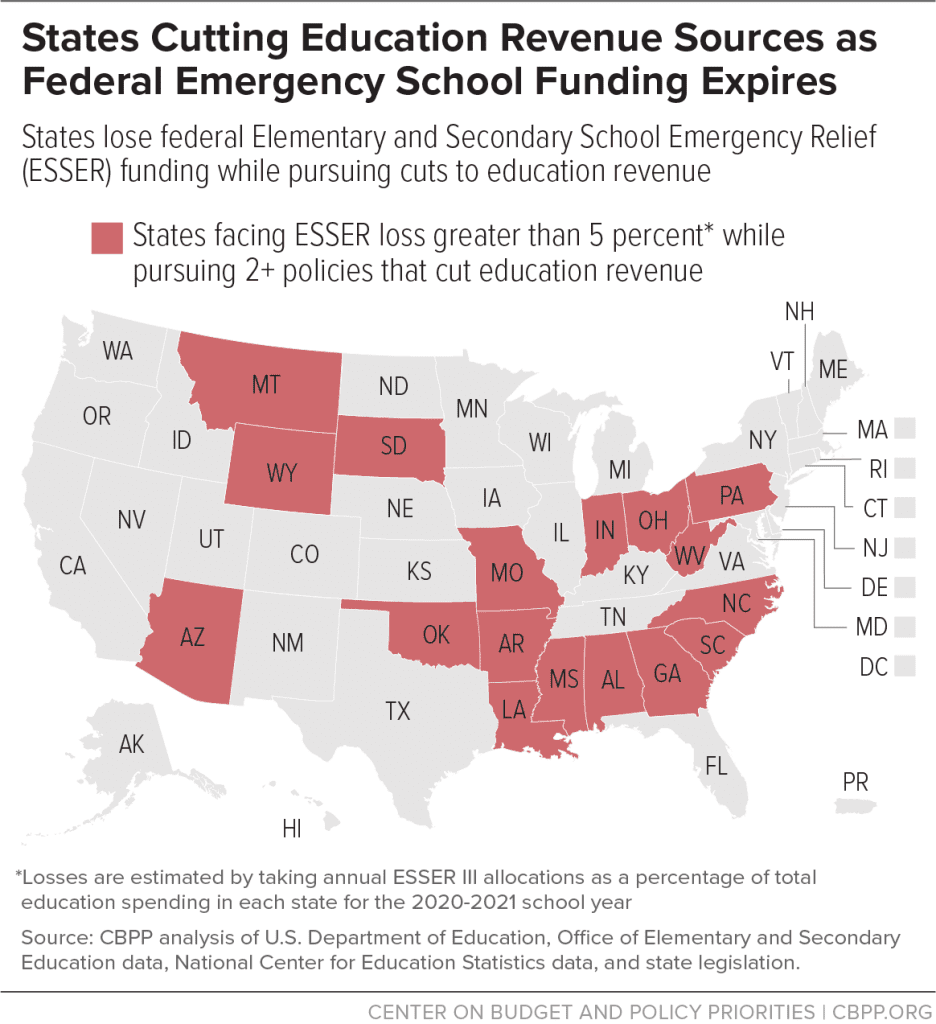

ESSER funds helped students begin to close the gap of pandemic-related learning loss, and helped districts address students’ mental health needs. Research shows that during the 2022-2023 school year, students exceeded typical pre-pandemic annual improvements in reading and math. Researchers estimate each $1,000 of ESSER spending will be worth $1,238 in students’ lifetime earnings alone, without accounting for the social benefits associated with improved academic achievement. However, achievement is forecast to remain below 2019 levels into spring of 2024 for higher-poverty districts. Because Hispanic, Black, American Indian and Alaska Native, and Pacific Islander students disproportionately attend high-poverty schools, the pandemic-related disparity in academic achievement could exacerbate racial inequities in education. Additionally, states with high proportions of high-poverty school districts are facing steeper funding losses due to ESSER’s expiration than other states. Many of these states are the same ones undermining recent progress from the infusion of federal funds by constraining important sources of school funding.

While ESSER represents a significant investment in federal funds (about 5 percent of annual education funding for states on average in the last round of disbursements), most education funding comes from state and local sources. Property taxes account for over 36 percent of public education funding while state income taxes are the primary source of general fund revenue that provides most state aid to schools. Cuts to these funding streams combined with the loss of ESSER funding could have significant consequences for academic achievement and student well-being. Three ways many states are undermining the educational gains students made because of ESSER funding include:

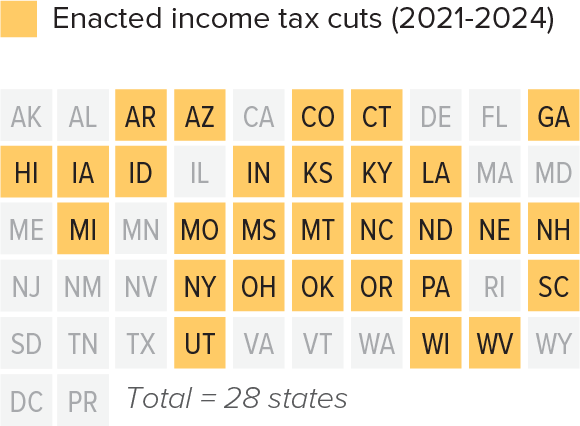

Personal and Corporate Income Tax Cuts

From 2021 to 2024, 28 states have passed personal or corporate income tax cuts. By the end of 2024, states are estimated to forgo about $16 billion in revenue that could have been used to continue addressing pandemic learning loss. For example, this year Iowa accelerated its income tax cutting plan, reducing its top income tax rate from 5.7 percent for tax year 2024 to a flat tax rate of 3.8 percent for tax year 2025. This will result in a loss of about $340 million for fiscal year 2025, which could have been used to address Iowa’s teacher shortage by hiring over 5,500 teachers at the state’s average salary.

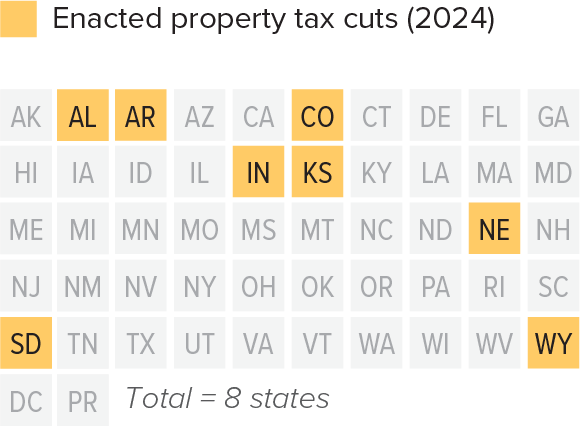

Untargeted Property Tax Cuts

In 2024, eight states enacted untargeted property tax cuts. One of those states, Indiana, further restricted the amount of property tax revenue that districts could collect for voter-approved levies for school operating expenses, resulting in a $20 million loss. This funding would have been more than enough to cover what the state has spent on summer school programs using ESSER dollars in a year. Additional property tax caps are likely to be debated during the race for governor and the 2025 legislative session, but such policies would further hinder Indiana’s ability to support student needs resulting from the pandemic. Three more states — Florida, Georgia, and North Dakota — are considering enacting untargeted cuts through ballot measures.

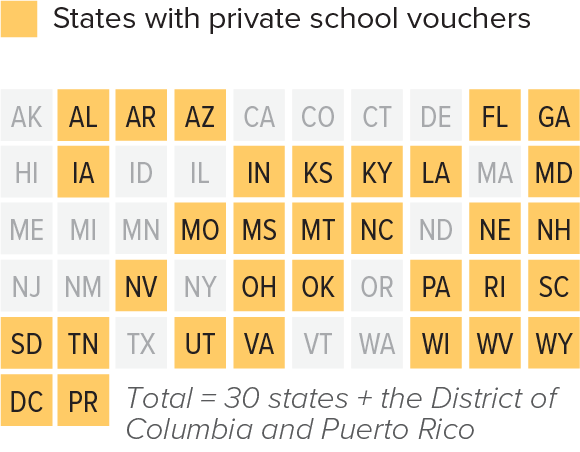

Private School Vouchers

Over half of states divert public dollars away from public schools to private schools through school vouchers. In 2024, 14 states enacted new, or expanded existing, school voucher programs, and Colorado and Kentucky are considering legalizing school vouchers through ballot measures. For example, Florida will spend almost $4 billion on its school voucher program this year, an amount that could easily replace Florida’s total annual ESSER loss if invested in public, rather than private, schools.

The combination of these policies with the loss of ESSER funds will result in significant decreases in investments in schools. For example, Arkansas is pursuing all three of these policies and is facing an estimated 6.8 percent decrease in education funding because of ESSER’s expiration. The ESSER loss plus the revenue losses from Arkansas’ property tax cut, and personal and corporate income tax cuts, plus shifts in funding to private school vouchers result in a total loss of $1.86 billion for fiscal year 2025. That was the equivalent of about 30 percent of total spending on K-12 education in Arkansas during the 2021-2022 school year.

Instead of cutting education funding sources, states should raise revenue progressively and keep public funding in public education. This will let them continue the critical investments, made possible by ESSER, to help eliminate pandemic learning loss, reduce inequitable education outcomes, and support students with mental health resources. For example, in 2024, New Mexico raised its tiered corporate income tax rate to a uniform 5.9 percent and raised revenue by applying the personal income tax to a larger portion of capital gains. This additional revenue helps fund a 6 percent increase in state spending for public education, which will go toward literacy programs, career technical education, and community schools. Similarly, in 2022, Massachusetts created a Fair Share tax on incomes over $1 million. Revenue from this tax accounts for over $750 million in education spending for fiscal year 2025, including mental health supports, early literacy programs, and universal free school meals. States that make these investments are choosing to help schools meet every student’s needs, which will lead to thriving communities and prosperous futures.