Why was Dave Ramsey’s financial literacy textbook approved in Florida? Questions remain

WUSF | By Kerry Sheridan | September 28, 2023

Florida approved Ramsey’s textbook, just as a new state law came into effect requiring a financial literacy course in order for incoming freshmen in high school to graduate.

Money guru Dave Ramsey’s personal financial literacy textbook has been approved for use in Florida by state education officials, despite concerns from residents who say it includes Bible references, and lacks academic rigor.

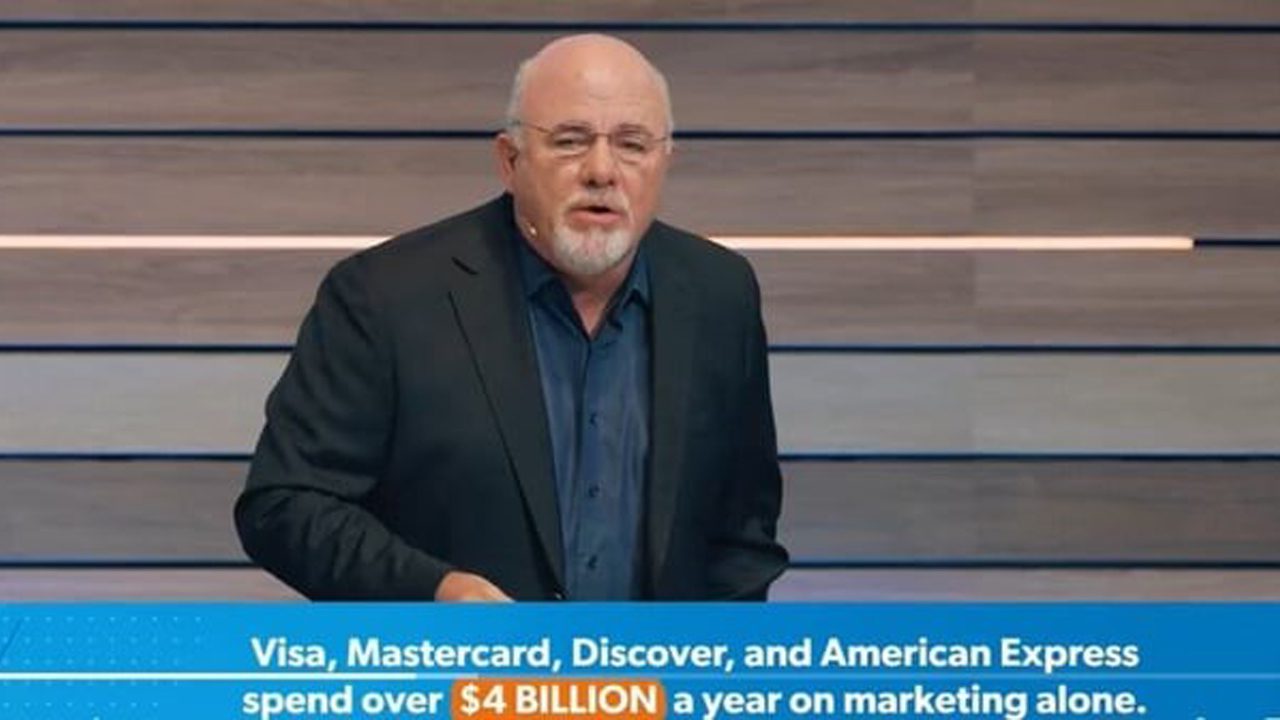

Ramsey is an evangelical Christian whose weekly radio show attracts millions of listeners. His textbook features a digital component with quizzes, and videos of him speaking on stage.

In those videos, Ramsey describes credit cards as “snakes,” questions the need for credit scores and says “the average home price in America today — higher in some areas, some lower in some other areas — is around $200,000.” The median home price in America is $407,000, according to the National Association of Realtors.

You can read the lessons and see the videos and quizzes more at the link here:

Username: Studentdemo@pasco.k12.fl.us

Password: Personalfinance

A total of 23 residents of Pasco County have filed written objections to the material, after the district signaled it planned to use the textbook, now listed on the state’s approved list for grades 9-12.

The Pasco County school district gave it preliminary approval during a school board meeting this summer.

“Lesson One has a quote from Proverbs 22,” said Beverly Ledbetter, a longtime social studies teacher who spoke against the materials at a Pasco County school board meeting in July.

“The Ramsey book does not further our district provision of a world-class education,” Ledbetter said.

Last year, Ramsey’s textbook, known as the Lampo Group title for Personal Financial Literacy, was on the state of Florida’s “not recommended list,” for K-12 social studies.

That changed this year, just as a law signed in 2022 by Governor Ron DeSantis took effect, requiring incoming high school freshmen to take a half credit in financial literacy in order to graduate.

Now, Ramsey Solutions’ textbook, Foundations in Personal Finance 4th Edition, is among four approved by the state of Florida for grades 9-12 personal financial literacy. It is the only resource on the approved list for an honors level course in financial literacy.

But adding to the confusion, the book has been approved for financial literacy courses that are expiring, and not for the new class required for graduation.

Reasons for the shift to approve Ramsey’s textbook remain unclear, but some say it aligns with a trend toward more conservative content making its way into classrooms in red states.

For instance, Florida has also given the green light for teachers to show free online videos by PragerU, a media company also headed by a right-wing radio host, Dennis Prager, who says his videos aim to “indoctrinate” children with Judeo-Christian beliefs.

“What we’re really seeing is a trend that’s happening nationwide, much in the same way that PragerU is now approved” in Florida and a few other states, said Jessica Wright, director of education and implementation at the non-profit Florida Freedom to Read project.

The Pasco school “district didn’t approve this for the graduation-required class. They approved it for the class that’s expiring that has less standards and less rigorous standards,” said Wright.

“At this point, Pasco seems to be the only one that’s even considering the Ramsey text. Other districts are either using (the textbook by) Goodheart Willcox or free resources like EVERFI, and then their teachers are supplementing with their own teacher-created resources,” said Wright, who is also a former teacher and mother of two in Pasco County.

Some districts “have decided they’re going to wait until these students are maybe sophomores or juniors so they can figure out how best to implement these new standards and implement a new text,” said Wright.

The new course that students need to take in order to graduate will require “much heavier math literacy,” she said, adding that the new regular financial literacy course has 16 more standards — and the honors course 19 more — than the course that’s expiring this year.

Wright said she has reviewed all of the Ramsey materials.

Since the state of Florida shifted Ramsey’s text from the not approved list to the approved list on August 18, “when I went into the online text, I did not see a significant difference that would have warranted that change, other than potentially district personnel asking for it to be added,” she said.

The Florida Department of Education and the Ramsey group have not responded to multiple requests for comment.

According to documents obtained by the Florida Freedom to Read Project and shared with WUSF, when asked why the Ramsey text was approved, a state board of education official responded in an email, referring to the LLC name for Ramsey’s textbook company, the Lampo Group:

“At the state level, there are no approved textbooks for the courses that were just approved by the State Board of Education a few months ago,” said the email from Katelyn Barrington, Director of Library Media & Instructional Materials at the Florida Department of Education.

“The Lampo Group title for Personal Financial Literacy Honors was originally on the not recommended list due to standards issues. The publishers work to correct those issues and can be added to the adoption list. It was added to the adoption list on 8/18/23, once fully approved.”

However, it’s unclear what issues have been corrected, if any. The Florida state education department web pages that show reviewer comments on the material remain unchanged.

Two of three reviewers recommended the Ramsey text for regular personal financial literacy courses, despite stating concerns like “most information infers Mr. Dave Ramsey as the expert due to content references on financial literacy with a biased view on some financial literacy education concepts,” from Reviewer 2.

The third reviewer recommended against it saying, “there is a spillage of his (Ramsey’s) views into the text.”

For the honors course, both textbook reviewers recommended against adopting the Ramsey textbook.

“The Ramsey text is a Ramsey product which does not completely offer a fair and balanced approach to personal finance. For example, saying having no credit is awesome could lead students down an unfortunate path,” said Reviewer 1.

“The instruction to students that they should be 100% debt free prior to investing, buying a home or car, or even saving is a major lapse in training. Current studies show that the two actions should go hand-in-hand,” said Reviewer 2.

“Instructing students to spend all disposable income erasing debt, rather than learning to appropriately use it to their advantage is too severe. Part of our work with this instruction should be to educate students on how to identify good v. bad debt (mortgage v. credit cards for instance) – not how to avoid it all together.”

“Additionally, the absence of independent studies leads the book to feel more like a marketing tool for the Ramsey program rather than an instructional guide for students from across all socio-economic sectors,” added Reviewer 2.

Ramsey’s website says “thousands of graduates go through our middle school and high school personal finance curriculum, Foundations in Personal Finance,” and has published a list of 17 states that require financial literacy in schools.

The next step in the process for Pasco County is for a hearing officer to consider both sides of the issue on October 10 at 11 a.m., according to Wright. The meeting will take place at the school board’s meeting room in Land O’ Lakes.

The officer is former Pinellas County school board attorney Jim Robinson. He was selected by the Pasco County School Board.

The hearing should be “pretty similar to what we really see on TV and in a court case. There’s someone with an opening statement, the other side has an opening statement. And it kind of goes back and forth,” said Wright.

Robinson’s task will be to decide “if this is essentially going to be an implementation of materials that benefit the overall district,” she said.