Sarasota School Board budget filled with unknowns

Herald -Tribune | By Ryan McKinnon | July 22, 2020

COVID-19 has made budgeting for the school year an exercise in ‘what-ifs’

The Sarasota County School Board will review its 2020-21 budget and property tax rates on Thursday.

The budgeting process has been complicated by the many unknowns of COVID-19, and district officials have had to build a budget without knowing how the pandemic will impact enrollment and if the state will end up having to slash funding if revenue shortfalls continue.

The proposed budget includes:

‒ A 2.7% increase in funding for operations, which primarily goes to salaries and benefits.

‒ A slight increase in local property taxes, due to state lawmakers increasing Sarasota’s “required local effort.”

‒ A major dip into reserves. The district will pull roughly $22 million from savings, bringing the total in the rainy day fund from $55 million to $33 million.

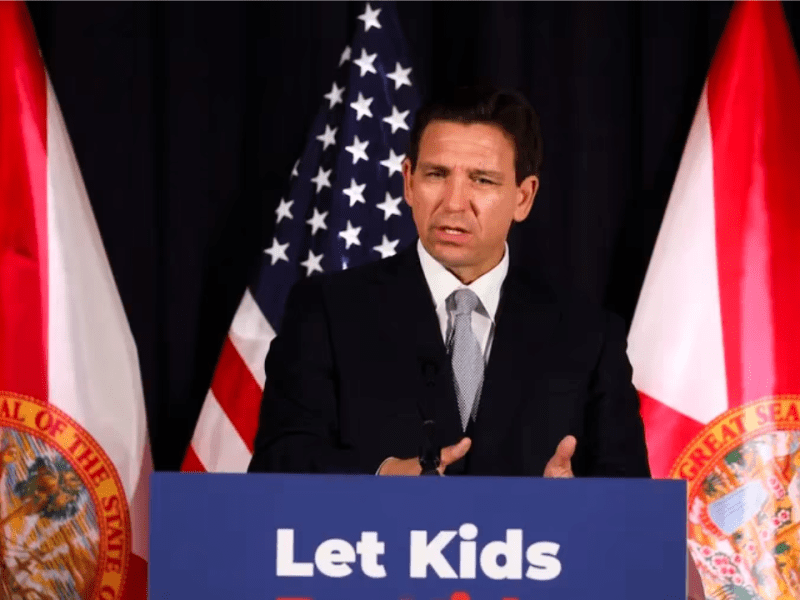

Sarasota’s operational budget includes $7.8 million in new state money to raise the minimum salary to at least $47,500. The funding is part of Gov. Ron DeSantis’ $500 million plan to boost the lowest teacher pay across the state.

How that will be distributed remains to be seen, but it will likely result in some unhappy veteran teachers. DeSantis focused 80% of the overall initiative toward raising all salaries to $47,500, and only the remaining 20% will go to raises for teachers who were already earning that much.

DeSantis also scrapped the Best and Brightest program, which gave some teachers thousands in annual bonuses but was excoriated by unions because of its controversial incentive structure.

School districts have been struggling to recruit new teachers, and DeSantis’ plan is focused on making the starting wage as attractive as possible.

While some districts may come nowhere close to getting all teachers earning at least $47,500, Sarasota is close. The starting salary in Sarasota last year was $44,300, and the district has the state’s highest average teacher salary, according to the Florida Department of Education.

In a normal year, how a $500 million boost to teacher pay gets divided would be one of the hottest topics of budget discussions. But this year, school boards are wondering what will happen if the state doesn’t have enough money to fund schools.

Board Vice Chairwoman Shirley Brown said there is a good chance that legislators will need to reconvene later this year to make budget cuts if state revenues continue to fall. Sarasota’s high property values ensure the bulk of funding comes locally, but if lawmakers do cut state funding, the district will feel it.

According to the budget, the state contributes roughly 18% of the funds for general operations, which largely go to personnel costs. If the state rolled back that contribution once the school year began, districts would have to get creative to pay teachers.

“Salaries and benefits are 85% of our budget,” Brown said. “You can’t get rid of a teacher mid-year.”

Reserves dwindle

The district’s general fund budget is projected to increase by 5.44%, from $477 million to $503 million.

The district often budgets to pull from reserves but tries not to. Last year the district had budgeted to spend $13 million in savings but ended up only using $4 million. But this year brings an array of costly challenges.

If the district ends up using the reserves already budgeted, the unassigned fund balance, referring to money on hand for any sort of unexpected expense, will have shrunk by 44% in the last two years. In 2018-19, the account had $58.8 million, and this year’s budget would shrink the rainy day fund to $33.2 million.

The School Board requires the district to have at least 7.5% of total expenditures in savings. The budget projects an end-of-year fund balance of 8.47%, still well above a state-mandated minimum of 3%. However, the balance was 14.7% at the end of 2018-19.

To decrease the budgeted reserve spending and mitigate against future cuts, board member Bridget Ziegler said she would like to see the budget remain flat from last year, but she wants those cuts to be made by individual departments and not at the board level.

“With the unknowns we need to be conservative,” Ziegler said. “Each department should look through and see where can you decrease costs. Look where you can. I know it’s not a practice people love to do. We need people to sharpen their pencils and figure out: is this a need-to-have or a like-to-have.”

Property taxes

Sarasota’s proposed property tax rate of 6.975 mills is a small uptick from last year. A mill equates to $1 for every $1,000 of a property’s taxable value. For a home with a taxable value of $250,000, the owner would owe $1,743 in school taxes.

This is the first time since 2013-14 that the millage rate has crept up for Sarasota property owners.

Enrollment

The biggest unknown for the district is how COVID-19 will impact enrollment.

At this point, the budget is anticipating a standard bump in enrollment. But if parents decide to home-school their children or enroll them in Florida Virtual School, the district gets nothing for those students.

Students who opt for Sarasota Virtual, which predates the pandemic and is a self-paced all online school, will only generate a fraction of what the district gets for full-time students — and the district only receives that money if the student completes the coursework.

The best fiscal option for the School District is for students to opt for a return to brick and mortar schools or enroll in their school’s remote learning option. Students in remote learning will follow a normal daily bell schedule and participate in live classes through video-conferencing technology, and the district will receive full state funding for these students.

As of Wednesday afternoon, Sarasota’s plans had still not received final approval from the state DOE, although districts with similar proposals have gotten the green light.