School Board Facing Fiscal Emergency

“The decline has eclipsed the Great Recession and Great Depression”

Mainstreet Daily News | by Suzette Cook | August 24, 2020

Alex Rella, Assistant Superintendent for Business Services for Alachua County Public Schools, stood before the School Board of Alachua County at the Aug. 18th meeting and presented the fiscal emergency facing Alachua County.

“The economics comes into play and things are changing very quickly,” said Rella. “What we are sure of is the second quarter for GDP (Gross Domestic Product) plummeted 30 percent,” he said and to put that in perspective he added that the decline has, “eclipsed the Great Recession (2008) and the Great Depression (1930s).

The July unemployment rate was 10.2 percent and there are 16.3 million people without jobs, Rella reported. State sales tax is down $1.8 billion and locally in Alachua County, the half-penny sales tax for schools down 28 percent for April, he said.

The State appropriated $35.2 billion in general revenue in the 2020 legislative session (sales tax and revenue from tax payers to state), according to Rella but by Aug. 14th the updated General Revenue forecast for the 20-2021 fiscal year was $31.6 billion which assumes a mid-year vaccine for COVID-19. That means a potential budget shortfall for the State of $3.6 billion for 2020-21 and $2 billion for 2021-22, a combined two-year loss total of $5.4 billion.

The Florida Educational Finance Program’s share of the loss is $892 million and that translates to Alachua County Public School’s prorated share of that potential reduction at $8,622,217

“There are no CARES Act funds available to the District to address this shortfall,” Rella said.

“There are no CARES Act funds available to the District to address this shortfall,” Rella said.

Rella then presented three options that could counter the State budget crisis:

- Raise taxes to increase revenue,

- Strip reserves to balance the budget and

- Convene a legislative special session and take steps to reduce the budget.

Rella said raising taxes is most likely not an option. Stripping reserves to balance the budget would increase interest rate costs and convening leaders at State level are stating they won’t have special session meetings until after the Nov. election.

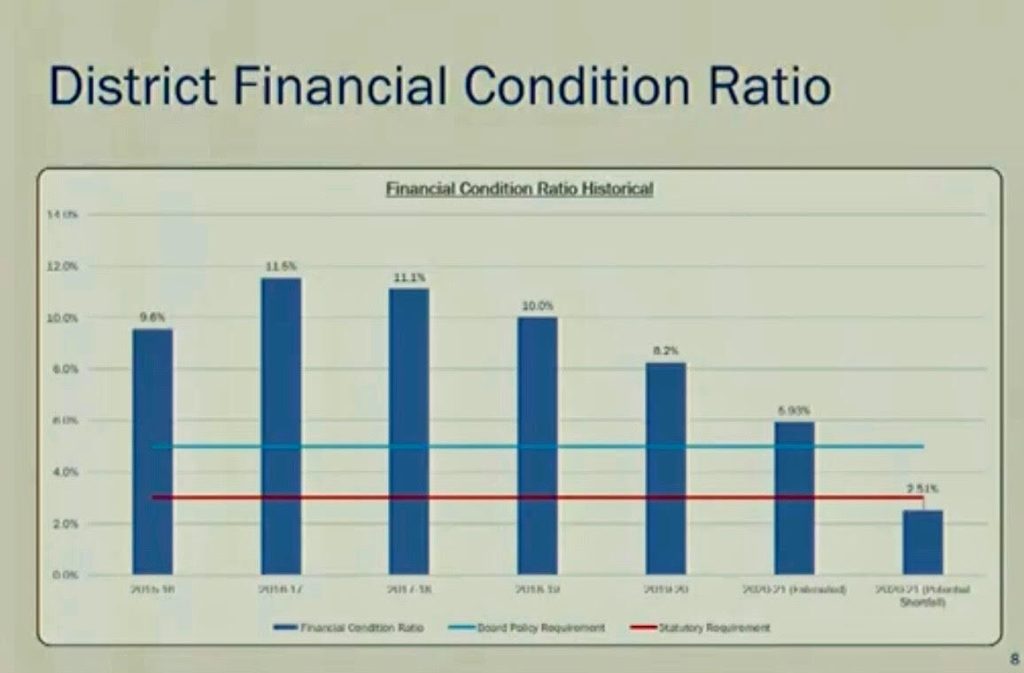

Rella turned to the financial condition ratio, which measure a school district’s ability to weather a financial emergency by comparing a district’s unrestricted general fund balance as a percentage of revenues.

According to Rella, if it is projected to dip below 5 percent the superintendent must develop and submit to the School Board a plan to restore this fund balance. If the ratio is projected to fall below 3 percent, the superintendent must provide written notification to the Commissioner of Education.

And if the ratio is projected to fall below two percent, the superintendent must submit a recovery plan to the Commissioner of Education. If the Commissioner determines the plan is insufficient to avoid financial emergency, the Commissioner shall appoint a Financial Emergency Board to operate the District.

SBAC Chair Eileen Roy said she thinks this is the plan of the State.

A chart presented by Rella showed the ACPS district’s financial condition ratio from 2015 to the projected 2020-21 school year.

It has ranged from 9.6 percent in 2015 then up to 11.5 percent in 2016. The ratio has declined since 2016 to 10 percent in 2018, 8.2 percent in 2019 and was projected to 5.93 percent for this year but with the added shortfalls, that prediction drops to 2.51 percent.

“It’s one number but there’s a ton of decisions the board makes,” Rella said to reach that number.

Rella explained where some of the shortfall for ACPS has come from.

“With these kinds of drops I would say primarily staffing is 80 percent of our budget.

“The raises, unanticipated expenses this spring of providing hazard pay for our employees,” he explained and added that the PPE was purchased out of reserve funds and the hazard pay for food service providing food all summers, the wi-fi, bus drivers all were paid out of the general fund.

Rella said the school district was under the impression that there would be some kind of reimbursement from FEMA, but FEMA is focused on providing aid to healthcare businesses, he said.

“At this point they are not reimbursing any of this.”

Board Member Gunnar Paulson said two members of the board “went through this before, 10 years ago.

“That’s when we cut our music in half,” he said.

Board Member Robert Hyatt asked about what proactive measures will be taken as the district approaches the 3 percent number and Rella responded that he has been having continuous discussions about “what if” measures with the staff and Superintendent Karen Clarke all the way back to November.

“Now we’re going to have to take another step of what is available on the chopping block,” Rella said.

SBAC Chair Eileen Roy said she thinks that failure of districts is by the design of the State.

“We are close to being taken over,” she said. “And I’m sure we wouldn’t be the only district in the state.

“One letter writer said it is ‘blackmail by the state forcing the opening of brick and mortar.”

“We flounder,” Roy continued. “If districts collapse that would suit a lot of people just fine because it would allow a faster move to privatization. It’s frightening, but also cautionary for us. I don’t trust the state.”