Opponents of half-cent tax for Duval school improvement say it’s not needed quite yet

Backers argue investment is vital to reduce mounting maintenance costs, portable classrooms

News4Jax | by Joe McLean | November 2, 2020

JACKSONVILLE, Fla. – Supporters of a half-cent sales tax, a referendum on Duval County’s ballot, have said the extra revenue is badly needed to get rid of some of the district’s more than 400 portable classrooms. Opponents contend it’s not the time for such a tax yet and that institutional changes need to be made first.

One of those opponents is Chris Oliver, father to a preschooler in the school district.

“It’s not that this doesn’t need to be passed, but it doesn’t need to be passed quite yet,” Oliver said. “There need to be reforms inside the system.”

The main reform in Oliver’s mind was a reprioritization of district spending such that funding critical maintenance needs is budgeted with the highest priority. He also said administrative salary reductions should be considered before levying a tax.

“There always seems to be enough money to pay for the superintendents, for the directors, for the principals, but there never seems to be enough money for the students,” Oliver said. “It’s totally wrong. It needs to be restructured.”

If passed, the tax is expected to collect more than $1.7 billion over the next 15 years with building safety upgrades planned for the first three years.

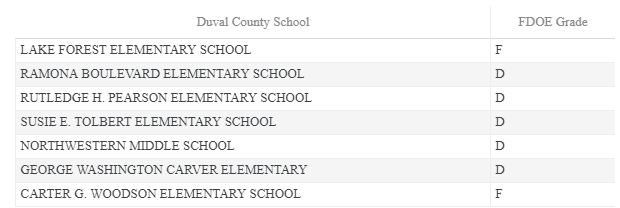

In a recent report, the Florida Department of Education identified 36 schools across the state as “low-performing,” seven of which were part of Duval County Public Schools.

Duval County School Board Chairman Warren Jones said funding facility improvements at schools will boost performance, lower crime and increase property values.

“I think, overall, we should support it because it’s good for our community and, most of all, is good for children,” Jones said.

A 22-member committee of citizen representatives will oversee the fund’s revenue and meet four times a year to review spending and progress on projects paid for by the sales tax to make sure funding is spent properly, according to the school board policy.

An independent audit of the district’s procedural ability to properly allocate the anticipated revenue found the district either fully met or partially met all six of the state’s criteria.

News4Jax constructed an interactive map showing where the district is planning to invest the tax revenue if the referendum passes. For more information and answers to frequently asked questions about the referendum, click here.

A similar ballot measure is being weighed by voters in Clay County’s school district.